Monthly Update #012 - December 2021

It is the last day of the year and I only have time for a quick update before the new year's preparations begin. Consider this the last chapter of 2021's Monthly updates and a teaser for a year in review to be posted sometime in January, once my exams are over and done with.

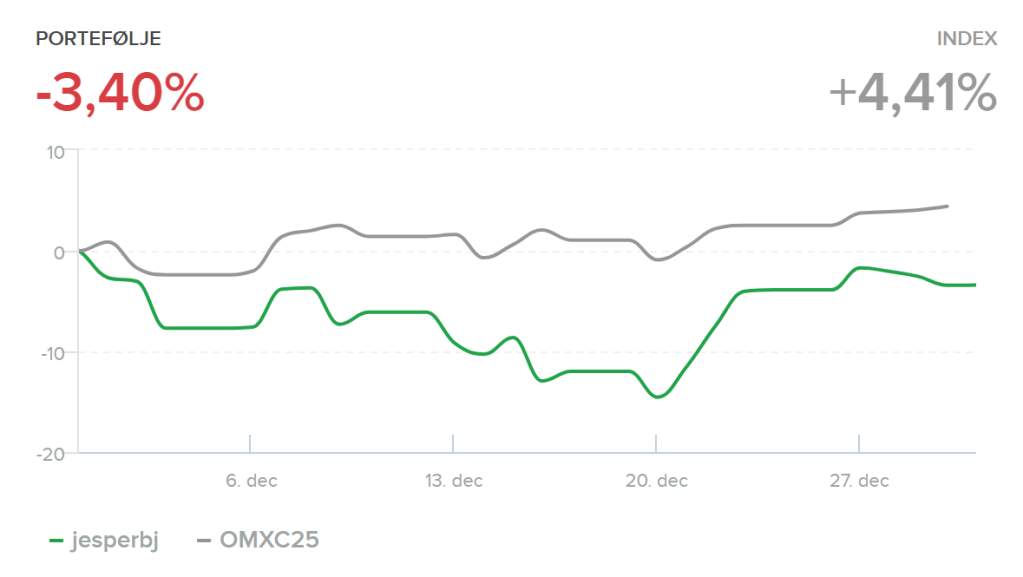

Growth Portfolio

Unlabeled in order from left to right: Xiaomi, Unity & Coinbase.

December became an opportunity for me to exercise a strategy known as tax loss harvesting. It means to sell out of your negative positions in order to gain a deduction in your tax bill. This year I sold out of Novo Nordisk (NOVO B) along with a few shares of Microsoft (MSFT) and also received dividends, meaning I can accept a decently sized tax bill for March next year. Selling my position in CRISPR Therapeutics (CRSP) which is down approximately 30% allows me to decrease the size of this upcoming tax bill substantially. The same can be said for slicing my position in AT&T (T) in half, which I reported on last month.

But hold up a minute... Did I not exit Novo Nordisk for the reason of entering CRISPR Therapeutics long-term? Absolutely I did - and I remain extremely bullish on the future of CRISPR and genomics - and so I continue to be invested in CRISPR, although now in a slightly more complicated way:

I have created what is known in Denmark as an "Aktiesparekonto" (Read: Stock Savings Account). It exists in a separate tax system from the other and comes with a few benefits and downsides:

I get to enjoy a 17% tax rate for the positions inside, compared to the regular rate of 27% to 42%.

Because it is a separate system I was able to repurchase my shares of CRSP without having to worry about a waiting period to allow for price fluctuations to legally ripe the benefits of tax loss harvesting.

A deposit ceiling is in place of approximately $15.750 for this type of account and it is limited to exactly one account per citizen.

Any gains will be taxed at the beginning of each new year, regardless of whether profits have been realized or not.

An overview of my positions in my so-called Stocks Savings Account. Look for an explanation below. "Resterene" / The remaining includes: CRISPR Therapeutics, Block & Embracer.

This type of account was only recently made available at my brokerage in late November of this year and so I have been waiting a good long while to take advantage of it. That has given me time to prepare and think long and hard about my strategy. In our tax system, this account type is ideal for buying foreign ETFs and that is exactly what many of my fellow citizens use it for - I however decided to mix things up a little. I bought the iShares Biotechnology ETF (IBB) which gives me some exposure to genomics and CRISPR, but not quite enough - so, in addition, I added the aforementioned shares of CRISPR Therapeutics, as well as a small position in Intellia Therapeutics (NTLA). I already maxed out the account as well as having taken advantage of a temporary lower purchase fee of $1.5 per transaction. Because of this, I decided to open several smaller positions in companies that I have followed with interest for a while - Including Alphabet (GOOGL), Sea (SE), Adobe (ADBE), Shopify (SHOP), and Meta (FB). I am however not planning on publicly sharing updates on this portfolio as there will be no changes made to it as the depositing ceiling was already reached.

In other news, Elon Musk has finished his stock sale which made my portfolio end on a very good note with Tesla (TSLA) returning to previous heights. I have also managed to acquire precisely 1.000 shares of Xiaomi (1810) in 2021 and I have decided that that is where I will limit my exposure to for now.

All in all, December ended up being less of the nightmare month that it set out to be.

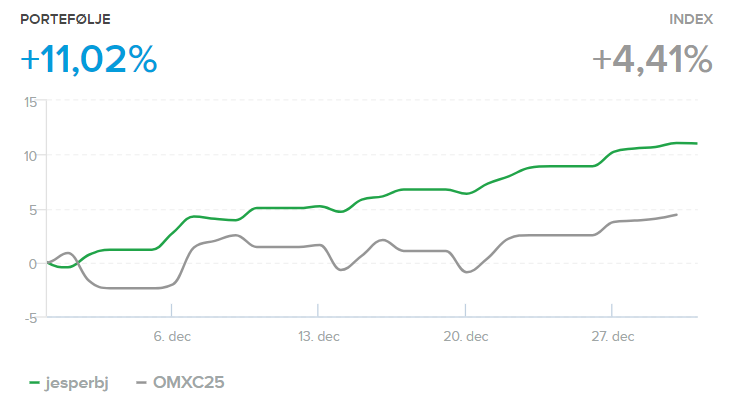

Dividend Portfolio

My dividend portfolio should look more or less the same compared to last month.

As so many times prior, nothing much has happened with my dividend portfolio - And I continue to enjoy that. Broadcom (AVGO) had a great quarter and I am already up over 15% on that position, which falls right in line with what I said about its valuation last month when I became a shareholder. It seems AT&T has bottomed out at around $22 per share and that made some hedge funds take notice of it and so the stock has recovered to around $25 - approximately 10% below my own average purchase price. Overall it has been a great month for value stocks which is clearly represented in the graph below.

Ending the year with a rally of 11% brings me to a total return of more than 30% for the full year.

As always, here are the total dividends I have received for the month:

| Name of Position | Payout Date | Amount (USD) |

| Microsoft (MSFT) | 10.12.2021 | $102.64 |

| 3M (MMM) | 14.12.2021 | $14.86 |

| Realty Income (O) | 16.12.2021 | $13.56 |

| Nvidia (NVDA) | 27.12.2021 | $0.80 |

| Total | Dec 2021 | $131.86 |

Total dividends received this month across all my portfolios – before taxes.

Website updates & Statistics

South Koreans paid the site a visit this month and I have no idea why :)

December has seen by far the lowest amount of traffic, largely due to this being the only post published this month.

While December was a low-traffic month, as expected - because of my exams and not having much time - I still did manage to hit a total of more than 20.000 visits for the full year. 20.250 to be exact. Thank you all for your interest in my first year.

Personal

December has been all about finishing and preparing for my exams (only 1 of 4 done so far). As I mentioned last month that has left this site a low priority. In the middle of January, those should be over and done with. Other than that I have completed my contract working for Google - which turned out to be a pretty good experience all in all. The rest of my time has been spent with my family celebrating Christmas and enjoying great food.

The year's gift harvest resulted in a few amazing things: Three new products from Xiaomi - A fitness band called Mi Fit 6, which I have worn ever since then, tracking my health stats and workouts as well as my sleep. My parents gave me the Xiaomi Mi Smart Air Fryer, which will play an important part in making crisp homemade garlic bread for the New Year's menu. I also received a gift card to spend on a product I have wanted for a very long time: The Xiaomi Mi Smart Projector Mini - an incredible compact DLP projector that now sits in my bedroom, projecting a 120" image onto the wall, with just stunning levels of brightness and clarity. I comes with built-in Android TV and life has never been better. I was also lucky to have received a super cool foldable bike helmet from my girlfriend, which folds completely flat to fit into any bag.

I hope you all had a great year - Both in the stock markets and outside of it. As mentioned at the beginning of the post, I plan on doing a 'year in review' type post sometime in January.

See you then!

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.