Monthly Update #006 - June 2021

At half a year of updates, my June portfolio overview is ready for those of you who are interested. It has been a quiet month in many aspects, but a great one overall.

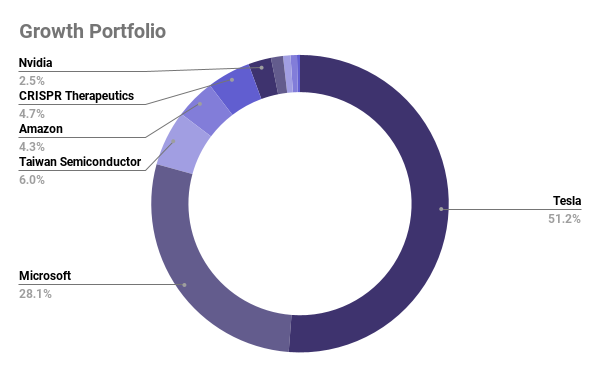

Growth Portfolio

Some slices are not labelled. They are in order: Xiaomi, Unity & Coinbase.

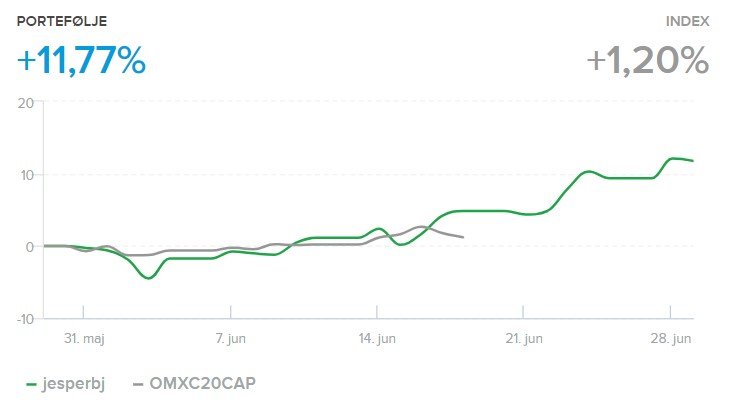

My growth portfolio regained its strength this month, up over 11% since May. This can in particular is attributed to Tesla (TSLA) which reclaimed its 1000% gain mark in my portfolio and now makes up just a little more than half. I will continue to hold this position for at least another few years. Nvidia (NVDA) also had a great run-up from around $650 per share to nearly $800 in the last 30 days. Nvidia did announce a 4:1 stock split in late May which is likely a factor for this growth. Nvidia continues to pleasantly surprise me with its performance and I am glad I picked it up alongside my position in TSMC (TSM).

Following a great month in my growth portfolio, I am back in the green and up 10% YTD.

Another winner this month is CRISPR Therapeutics (CRSP) which finally broke free from the $130 range and into the $150's. I lowered my average price to $115 when I doubled my position last month - I am glad I did. It closes in on making up 5% of this portfolio and has seen quite the boost spilling over from a breakthrough by close competitor Intellia Therapeutics (NTLA) giving credit to the technology's use in medical treatment. NTLA, which you may recall was also a top pick for me when looking into CRISPR in general and while I feel good about doubling down on CRSP instead, it was pretty crazy to witness the stock go up 50% in a single day from this announcement.

Coinbase (COIN) has recovered a little this month from its drastic fall since its public offering. This is due to the company being the first business ever to receive a so-called crypto license in Germany, one of the largest markets in the world, and where they will now be able to expand their product offering. While I am still down significantly on this position (around 33%) I remain hugely optimistic about the company and as it makes up less than 1% of my portfolio, I feel like it is only an opportunity to add more to my position in the future. Coinbase and Unity (U) are two companies I truly believe in and would love to make a bigger part of my portfolio, but where I feel no rush to go and buy right now as they will still likely be part of my portfolio in 10 years. Gives me plenty of time to buy a good evaluation.

Xiaomi (1810) is the only company from which I purchased some more shares this month. I have added another 100 shares over the course of June, but it still remains less than 1% of my growth stocks. I will continue to average into this company over the year 2021 and expect it to be one of my largest position over the long term. But there is a long way to go on a student budget... Xiaomi phones are now listed by every local carrier in my country, ironically with the exception of the one I work for. This is a huge departure from only a year ago, when only a single carrier had partnered with them. Xiaomi is also part of the newly announced Android 12 preview program and I continue to be excited for their future in both mobile and IoT.

Finally, I wanted to end on a note that I just published my teased writeup on Tattooed Chef (TTCF). Let me know what you think!

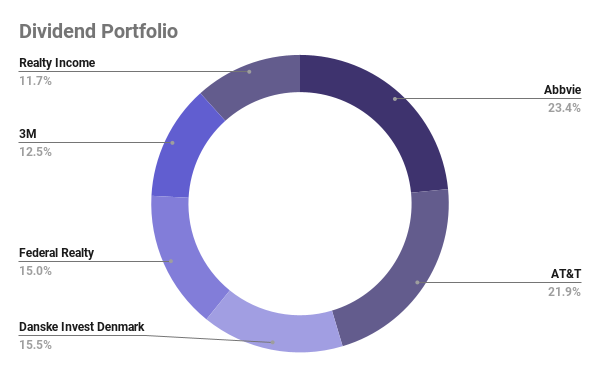

Dividend Portfolio

My dividend portfolio has been in a stand still all month.

My dedicated high-yield dividend portfolio has been rock solid this month with a 1.6% gain over the last 30 days. This is exactly what I expect and want from this portfolio: Stability and slow positive growth. There is still no new information out surrounding last month’s WarnerMedia/Discovery merger but continue to be patient and plan on continuing doing nothing as long as my dividend is safe.

This month the dividend portfolio followed the market pretty closely, though with a slight edge.

Here is the dividend breakdown for the month of June:

| Name of Position | Payout Date | Amount (USD) |

| Microsoft (MSFT) | 11.06.2021 | $90.27 |

| 3M (MMM) | 15.06.2021 | $14.50 |

| Realty Income (O) | 16.06.2021 | $6.23 |

| Total | June 2021 | $111 |

Total dividends received this month across all my portfolios – before taxes.

It is nice that I seem to have hit a very stable dividend payout rhythm - whenever my high-yielding stocks are skipping a month some of my larger positions from my growth portfolio like MSFT and TSM step in to make up the difference. This is of course all by chance, but overall just really nice. No new purchases were made this month, of course with the exception of my automatic commission-free purchase of a Danish index fund.

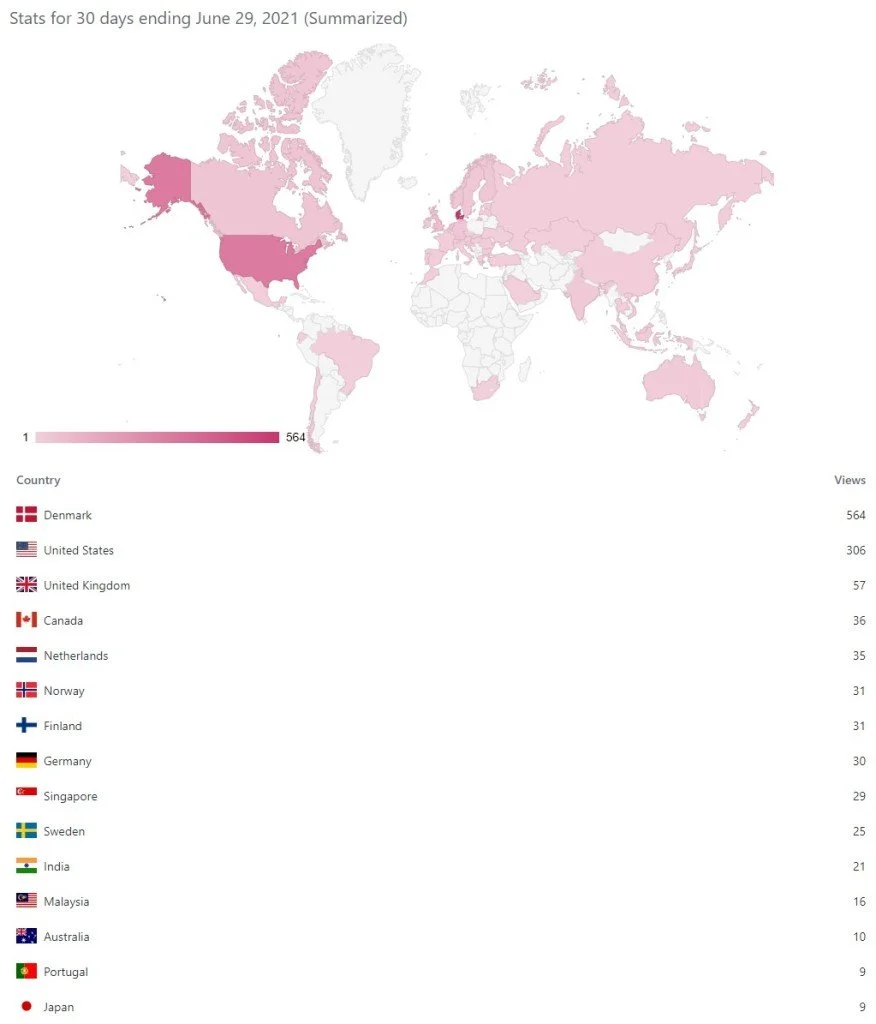

Website updates & Statistics

I continue to get a more evenly distributed visitor base from all around the world.

I am glad to see my visitor base further diversify every month. I am pleased to see people from all over the world seem to be interested in my content. In regards to the visitor count it is in every way intentional: I wanted to see what would happen if I stopped actively allocating time in promoting my site. I still shared links to my posts on various social media, however I did not spend much time doing it and only did it when it felt completely right. In return I have been given more insight into how my website naturally growths and how users reach it. I took some 'time off' you might say from working hard on spreading the word and also a spent a little less time posting new article and sitting in front of my computer in the summer heat. I have still gained new subscribers and I also spent some time rebuilding the frontpage - so overall I am happy with the tradeoff I made here. And to my new subscribers: Welcome. I am glad you are here and I hope you will enjoy what I am sharing with you.

Personal

In regards to my personal life a lot of good has been happening. I have wrapped up my first full year of University passing all of my exams by June 16th. My final oral exam in Physical Computing went better than I had expected and turned into a great way to end year 1. I can now enjoy a break from my studies until late August.

In the meantime, I will be taking on some more shifts at my part-time job at TDC as well as dedicating some time to looking for new opportunities. I am hopeful that I might find a more relevant job to my studies in design and technology within too long. I do enjoy the stability and convenience that my current job offers but I am looking to challenge myself further and expand on more relevant skills. I am already in talks about an exciting opportunity with a well known technology company, but I will refrain from sharing any more details until I find out if its a good fit for both parties. In either case I am glad that I have a reliable income next to my studies already.

In other news, my girlfriend and I has booked a small trip to Rome over the summer, which I am especially excited about. I have visited the city two time prior and am looking forward to show her all the beautiful places and artifacts there that inspire me and have left me in awe of human capability. I wish you all a great summer and remind you to remember enjoying life outside of the stock market as well. Cheers.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.