Monthly Update #005 – May 2021

Another month has gone by. It is time for another update. In these posts I like to go over my investment portfolio performance, new purchases, collected dividends as well as updates for the site and sometimes what goes on in my personal life. Lets get to it.

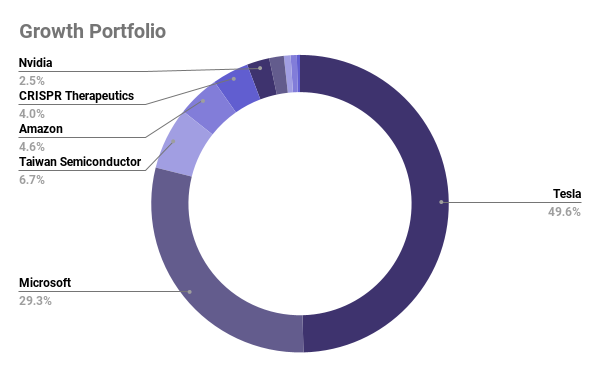

Growth Portfolio

Some slices are too small for the labels to appear. In order they are Xiaomi, Unity, Coinbase.

In regards to my growth portfolio, it has not exactly been a great month. However, I do finally feel like the market is starting to calm down and volatility is decreasing. Right now, I am honestly all aboard that. I miss some stability and being able to once again see value reflected in companies individually rather than based on the general market health.

The drop of 8.5% this month finally brought me into the red for the Year to Date.

This month on of my prime positions CRISPR Therapeutics (CRSP) managed to drop just below $100 per share. With an average price of around $130 in that stock - and feeling pretty good about that - the temptation became too much. I sold another 15 shares of Microsoft (MSFT) finally maximizing my annual realized profits at the lower tax bracket (27%) and doubling my position in CRSP. And so, my new average sits at $115 which I am extremely pleased with. Should the stock ever drop below $100 again, I will do everything in my power to pick up some more. Currently the stocks sit at around $110 and seem to be slowly recovering.

My best performer for this month is actually my newest purchase: Tattooed Chef (TTCF) which I mentioned shortly in last month's update. In the short amount of time I have owned this stock it has rallied almost 27%. The company delivered a great earnings report this quarter, finalized the purchase of a Mexican-style operation, and apparently broke sales records for Target. They are entering Whole Foods nationwide in America and seem also to finally break into Europe. I plan to do a full post on this stock soon - it is a truly exciting operation and I believe their future is bright.

As I also mentioned last month the funds for the purchase of Tattooed Chef came from my exit of Virgin Galactic (SPCE). Virgin Galactic did finally manage to deliver on their promised successful test flight this month and despite my long term exit from the company did still manage to take advantage. In true Wallstreetbets style I put what is supposed to become next year’s tax bill into the company right before the announcement. I managed an average price of $15.5 and sold right after the flight at $25 to again secure and transfer the funds out of my brokerage to set aside for next year. I watched the live stream and it was truly an incredible feat and display of skill. I wish nothing but the best for their future endeavors - and hope one day to become a client of theirs.

Last but not least, right after I did my thesis on Xiaomi (1810) and their future in IoT and Internet Services the company delivered another jaw-dropping earnings report. Following that event I shared my thoughts on the company on various social media platforms and received a ton of great feedback and new perspectives. As a result, I have bought another big chunk of shares in the company this month. I am up around 7% on the stock already and am working hard to add as much to my position as possible. This company has quickly turned into one of my highest conviction stocks and I will continue to buy more shares in June and beyond.

Dividend Portfolio

AT&T moved from first place to second this month.

For my dividend portfolio I crossed a big milestone in May. For the first time the total market value of this portfolio is above 100.000 DKK. Considering I did not open these positions until October last year and I am really proud of the progress I have made in such little time.

A little bit in the red this month which can mainly be contributed to AT&T.

As always - here are the dividends I received this month:

| Name of Position | Payout Date | Amount (USD) |

| AT&T (T) | 04.05.2021 | $62.91 |

| AbbVie (ABBV) | 17.05.2021 | $42.81 |

| Realty Income (O) | 17.05.2021 | $6.33 |

| Total | May 2021 | $112.05 |

Total dividends received this month across all my portfolios – before taxes.

I have made no new purchases in this portfolio in May besides the small automatic and reoccurring monthly buy-in into a local ETF - Danske Invest Denmark Index (DKIDKIX). However it has been uniquely interesting as my biggest position at the time, AT&T broke the news that they were spinning off WarnerMedia and merging it with Discovery (DISCA). The move has created much discussion among investors and also resulted in a sell-off of the stock over fear and uncertainty. Most importantly though - The imminent loss of AT&T's status as a Dividend Aristocrat. The company plans to cut its dividend in half as the deal is finalized and that has given me and everyone else a lot to think about. For now, as I have mentioned in a post about the deal, I will be sticking around. I need more information in order to make the right judgment and the dividend will be safe until sometime in mid-2022. The good news is that I will receive shares of the new company instead and have a part in the second largest media house of all time if I decide to hold until then.

Website updates & Statistics

For the website itself, I have only managed to improve a few things. I have made an overview of my portfolio and 5-year performance freely available on the homepage. I plan to further improve this - at the very least for my own sake so that I won’t have to manually update these every month. Unfortunately, the tier of WordPress that I am subscribed to is annoyingly restrictive in this regard. Something that has made me consider switching platforms to Squarespace (SQSP) which I have had a great experience with in earlier years and which fittingly just went public this month.

As I will expand on in the next section I have been insanely busy this month and so it has been a struggle to hit my goal of having more readers of this blog every month. Fortunately, a lot of people seem to have interest in my Semiconductor situation overview post this month and my post on Xiaomi also managed to stay on the front page of /r/stocks on Reddit for a day despite Chinese stocks being a controversial topic there.

I saw the biggest uptick in non-Danish readers ever this month by the grace of Reddit.

Personal

The reason for the struggle to reach my ambitions for the website performance in May is clear: I had exams. Just yesterday I handed in my fifth and final exam paper of the semester in what has been the absolute toughest exam period I have ever gone through. Due to the pandemic, all of our classes have been online and because of this, the exams were also restructured. All of our exams became written hand-ins - one for each class + another as part of a group exam. I have written hundreds of pages and many within short deadlines of each other. I believe and hope that they all went well - but it has more or less occupied all of my time and slowly drained my will to live.

What is left is a single 20-minute oral exam where I get to present the work I have done for the class *Physical Computing'. By far the most stressful however was my class 'User Interface Design' which consisted of both an individual and group report. It did however turn out pretty cool and below I share our radical redesign for browsing Netflix on the mobile app.

In this demo (Created in Figma) we have improved the browsing experience on Netflix mobile with full-screen vertical video previews. If you happen to like a title, you can swipe right to add it to your watch list. If not just swipe left and discard it to remove it from future suggestions. If you and a friend or a family member's profile both have the same piece of content on your list, you will be notified so that you can watch it together.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.