September 2022 - More market chaos

September has been quite an eventful month, although not a particularly great one for the stock markets. Chaos reigns in Europe where rising inflation and energy prices remain a problem. In the US the FED continues to strike fear, confusion, and doubt. I have made some changes to my portfolio this month, as a matter of prioritization in these tough times.

Changes to my portfolio this month

I have made my exit from one of my holdings entirely while continuing to double down on Unity (U), but I have… again… entirely unexpectedly started a new position, due to the conditions of the market.

Growth Portfolio

Overview

Unlabeled on the chart: Alphabet (1.3%), Adobe (0.6%) and Coinbase (0.1%).

Moves

On September 7th I increased my position in Unity at a price of $38.84 per share, lowering my average to $64.90.

On September 14th I sold my entire holdings of Xiaomi (1810) at a price of 10.40 HKD per share, marking a loss of 55.56%.

On September 16th I further increased my position in Unity at a price of $36.40 per share, lowering my average to $62.84.

On September 16th I started a new position in Adobe (ADBE) at an average price of $300.59.

Performance

My Growth portfolio lost 6.27% of its value over the past month, in comparison to the market at a near 10% loss.

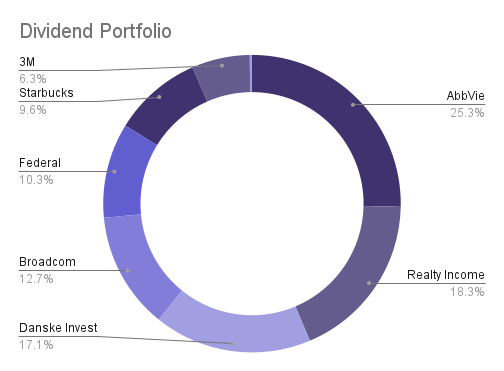

Dividend Portfolio

Overview

Unlabeled on the chart: Orion Office REIT (0.3%).

Moves

A small automatic buy order of the Danish Invest Denmark Index ETF went through on the 8th - Which I aim to continue doing every month this year.

Performance

My Dividend Portfolio dropped 7.59% - wholy out of the ordinary.

Dividend overview

| Name (Ticker) | Received | Amount (USD) |

| Microsoft (MSFT) | Sep 9th | $90.27 |

| 3M (MMM) | Sep 13th | $14.40 |

| Realty Income (O) | Sep 16th | $13.36 |

| Nvidia (NVDA) | Sep 30th | $0.80 |

| Comparison YoY | $112.73 (Sep 2021) | $118.83 (+$6.10) |

Dividends received before taxes. Comparison to the same month a year prior.

Commentary & Review

Another tough for the markets overall and quite an eventful one for my holdings, considering we are out of earnings seasons. The month started out with some rather positive news: Unity rejected the acquisition offer from AppLovin (APP) and on the 13th they redrew the offer completely. Given that a company was willing to pay $58.85 per share and the deal was deemed not good enough by the Unity board, I thought it a fantastic idea to pick up a few more shares at just $38.74. But as we are quite used to by now, macroeconomics controls the course - and so a few days later on the 13th, even though US inflation rates went down, it was not quite up to expectations, and the entire market took a nosedive, bringing Unity back down with it.

In this same time period, another software company, which I follow with great interest shared big news: They (Figma) are being acquired by Adobe (ABDE) for $20 billion. This is the biggest acquisition of a private technology company ever announced, according to Qatalyst Partners, and by far the biggest one of Adobe. Figma is another piece of software I use day to day in both my professional life and as a student. It is an incredible cloud-native design tool, which from the moment I first tried I knew would shake Adobe to its core. Over the past 2 years, I have followed its founder Dylan Field closely and hoped for a chance to invest in the company one day. This newly presented situation made me consider my position in the market: I have a lot of losers among my newest positions of this year and the last. Would it really be a good idea to start another new position, rather than double down on what I already own? As I saw Adobe’s stock go over a cliff, dropping 15-20% from the news, I made a decision: Better to take a loss now, write it off on my tax bill and jump on this long-awaited opportunity. So on the 14th, I made the decision to let go of my position in Xiaomi (1810) and buy myself a few shares of Adobe. To be clear: I am not just buying Adobe on how Figma may play into it going forward: I like their business, to begin with, and the stock has had its place on my Watch List before. I plan on doing a write-up exactly on Figma changes the investment thesis around Adobe, but to make a long story short: If the Figma deal goes through, it is immensely positive for Adobe in the long term - if it does not, it is seemingly good news in the short term.

While I still believe my thesis on Xiaomi to be intact, it has suffered heavily under the Chinese Crackdown of last year and supply chain challenges, the semiconductor shortage, and more. The Chinese economy is now at a low point and the stock continued to bleed in the days following my exit. As of now, Xiaomi is trading at 8.9 HKD, down from 10.40 HKD when I sold just two weeks ago. The last time Xiaomi traded at these levels was all the way back in 2019. It pains me to let go of shares of a company I deem of such quality and innovation, but this time I had to admit defeat to macroeconomics. Even averaging down on my original entry price I had to take a 55% loss, unable to compete with the vast forces going against me. I may enter Xiaomi another time, but I have decided to not pursue Chinese stocks until trading availability increases- as it has required quite the manual labor to trade on the Hong Kong Stock Exchange, because of not being offered on my brokerage.

Lastly, I think it is worth mentioning Unity announcing price increases for the first time in several years, likely pushing further towards profitability this year. As I started my position in Adobe, I again bought a few more shares of Unity - this time at 36.40, following this market downturn. Taiwan Semiconductor Manufacturing Company (TSM) has been demolished this month, reaching a 52-week low. Outside of the overall market, this drop can be attributed to probably the first piece of negative news surrounding the company I have stumbled upon in my years of holding: Large clients like Apple (AAPL) and Nvidia (NVDA) have rejected a planned price increase set by TSMC of 6%. Ironically, there have been much positive development from the company since my entry, but regardless, I am now in the red on my position of for the first time. This means I may be looking into allocating some funds this way in the near future also. TSMC is one of the most important companies in the world and makes a ton more profits now than it did when I first became a shareholder. I do not really see exactly how Apple and Nvidia can reject TSMC, as the alternative to their services is non-existant. It will be interesting to see.

Dividends

September marks a month of slight dividend growth, without a big change in positions paying out. Also immensely positive is the news of Microsoft (MSFT), my second largest position overall, raising its dividend by 10%, and Starbucks (SBUX) raising theirs by 8.2%. I may still only do small numbers, but I love getting a raise!

Research & Goals

Not much time has gone into researching companies this month. I have been at work relaunching the site as www.jesperb.com. I hope you really like it - at the very least it should look a lot cleaner now and be easier to navigate. When a ticker is mentioned in one of my articles from now on, a link can now take you to anything I may have written on this particular stock. Also, my portfolio on the front page now updates in real-time, rather than being a static image and my project portfolio can also be found on this site now, combining my two previous websites. (jesbaek.com and hirejesper.com).

I did of course stay up all night last night to watch Tesla’s AI Day 2, which was super interesting - although I do not know what to make of it yet.

Watch List

Growth Portfolio

| Name (Ticker) | Conviction (Rank) |

| Embracer (EMBRAC B) | 1 --- |

| Sea (SE) | 2 --- |

| Meta (META) | 3 --- |

| Shopify (SHOP) | 4 --- |

| Palantir (PLTR) | 5 --- |

| MercadoLibre (MELI) | Contender |

Dividend Portfolio

| Name (Ticker) | Conviction (Rank) |

| Bank of Nova Scotia (BNS) | 1 --- |

| Costco (COST) | 2 --- |

| Elkem (ELK.OL) | 3 --- |

| JP Morgan (JPM) | 4 --- |

| Digital Realty (DLR) | 5 --- |

| Lockheed Martin (LMT) | Contender |

There have been no changes to my Watch Lists this month.

Goals

Short term I wish to continue to increase my position in Unity - potentially TSMC as well.

For the year 2022, I prioritize buying growth over dividend stocks.

I have no plans to open new positions in my Growth Portfolio. (whoops)

I do not plan on selling out of any more positions this year. (double whoops)

In my 2021 year in review, I stated that I aim for a 35% return in 2022. I continue to strive toward this goal although I have accepted its unlikeliness. Currently, I am down 17.53%.

Over the long term, my goal is to slowly shift towards more stable positions and dividends on my journey towards financial freedom.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.