Monthly Update #004 – April 2021

It is time for another update post. In these posts I like to go over my investment portfolio performance, the dividends I receive, any moves I might have made in the market as well as an update on the site and sometimes I share what is going on in my personal life as well. Let us get to it!

My investments

I always like starting off by talking about my growth portfolio - which makes up a little over 90% of my total investments. Fortunately, the markets have rebounded a little this month following the downtrend of February and March and the same holds true for me. I continue to experience more volatility than I like to but looking at the month overall I am glad to end in the green.

Ultimately my growth portfolio has traded mostly sideways though it has not been a smooth ride this month.

Given all the activity and new purchases I made last month I had not expected to report anything out of the ordinary for the month of April. But as you might have noticed if you follow along on the site, I became a day one shareholder of Coinbase (COIN) stock when they finally went public in the middle of this month. Coinbase is the largest cryptocurrency exchange in the world and also the first one to go public. I wrote an in-depth post on why I invested. I got in at open at $381 per share which may seem a little high in comparison to where it sits now.

The reality is that I and many others had no idea where to value this company. I was excited to get in and given that I plan to hold this stock for many years I was not too worried about the price. The stock now seems to have settled in the area of $300 per share, giving the company a market cap of $55 billion, which probably does sound a little fairer than the near double that it reached on day one. It is however not unlikely that I will buy more shares of Coinbase and use that to average down in a continued effort to put at least 1% of my net worth into crypto-related assets.

You can use my own referral link for a $10 bonus on top of your first investment above $100.

Another event that I definitely had not expected was that I would suddenly exit my position in Virgin Galactic (SPCE). Virgin Galactic is an exciting company founded by Sir Richard Branson, the man behind Virgin Group and one of the richest people on the planet. They are trying to make space tourism a real thing - and are working hard towards making it a true experience for anyone willing to drop $250.000 for a ticket.

I bought in at a really exciting time back in October last year right before the company was set for an important test flight to grant them FAA approval. That also meant I got in at an attractive price of $22 per share. After a short delay, the test flight finally happened in December but did not go quite as planned. The computer inside the spaceship reported an error and the company was forced to ground its operations. The test flight was rescheduled and as a long-term investor, I continued to be excited about the eventual test flight success. Originally Richard Branson was supposed to be a passenger on the company's first commercial flight in Q1 2021 after the company would have been granted FAA approval and that would have been another great catalyst for the company - especially for publicity.

In all this time the stock saw a steady price increase as hype began building for the evitable and as ARK invest announced their plans for a Space ETF - as an early adopter I just sat back and enjoy the show. As February came around and a new flight window opened the stock peaked at just below $60 per share. I was ecstatic about a near 200% return in just a few months and kept a close eye on every move and news out of the company.

The newly unveiled Spaceship III by Virgin Galactic - Clearly it is more than just a spaceship.

And then... Things turned sour. The test flight never happened. The stock began dropping rapidly as we heard nothing and the market also took a turn. On the company's earnings call later in the month, it was revealed that they were facing a more complex issue than first anticipated and the test flight was rescheduled yet again to some time in May. By this time the stock had nearly halved from its previous high and one of the most important and public figures in the company Chamath Palihapitiya, the man who helped the company go public via SPAC, suddenly dumped all of his shares - around $213 million in early March. The stock tanked massively and dropped below $30 again. At this time I put a stop loss in place at my entry price of $22 as my confidence in the company began to crumble.

Then in mid-April another major blow was delivered as Richard Branson himself sold out of the company. Travel-focused Virgin Group has understandably had a rough time in the pandemic and Branson told the media he would sell a stake in Galactic to cover his other businesses. As he dumped more than 5.5 million shares for around $150 million the stock hit record lows since the time I picked it up in October and my stop loss triggered and I thankfully came out of this whole ordeal absolutely neutral, no richer, nor poorer than before.

It is safe to say that I have never experienced such a roller coaster of ups and downs in stock before - even at the most volatile times in Tesla (TSLA) around the Model 3 ramp-up. I hope to see the company eventually succeed but I call myself lucky to come out on the other side only having learned a lot and not taken a loss - unlike many unfortunate people who bought into the hype at its peak in February this year. The business of Space is probably the hardest in the world - It is literally rocket science - and delays and implications are to be expected. But one thing that I do not find easy to deal with is when a company's founders pull out at the worst times possible.

Virgin Galactic stock has been a true roller coaster in 2021. Currently trading around $22.

Had Virgin Galactic delivered on its promises and sent Richard Branson to space in early 2021 is it possible that I would have sold at least part of my stake in the company, as well as the hype around the company, could have created a momentary bubble over $100 Had this been the case, Virgin Galactic would have funded my second round of buying into CRISPR Therapeutics (CRSP) but alas this will not be the case. Instead, I allocated the money from my stop loss to another company I have had my eye on for a while. That company is Tattooed Chef (TTCT), a company specializing in plant-based offerings and another SPAC. This company makes for a very attractive case and I am very bullish on its future. As I saw the shares drop heavily only a few days after my exit from SPCE the temptation became too much and I picked up everything I could get at around $17 per share. It is important to note however that the drop came as a reaction to irregular financial decisions internally in the company - And that obviously increased the risk. But there is a lot of really great stuff about this company as well, which I might do a deep dive on some time as well.

As of the end of April my growth portfolio looks like this. "Resterende" is Coinbase. Besides this new small addition the only real difference is Tattooed Chef replacing Virgin Galactic.

Finally, I want to touch on my dividends. Both my REITs contributed their part to my dividend payout this month - but the most significant stream of revenue for me in April actually came from TSMC - which is now my third largest holding in my growth portfolio and which pays around a dividend just below 1.5%. As always I continue to reinvest all received dividends. I have many no changes to my dividend portfolio this month, with the exception of a once-a-month reoccurring buy into a Danish index ETF type investment that I can contribute a small amount of money into without having to worry about brokerage fees.

| Name of Position | Payout Date | Amount (USD) |

| Nvidia (NVDA) | 1.4.2021 | $0.82 |

| Taiwan Semiconductor Manufacturing Company (TSM) | 16.4.2021 | $35.34 |

| Federal Reality Investment Trust (FRT) | 16.4.2021 | $21.29 |

| Realty Income (O) | 16.4.2021 | $6.37 |

| Total | Apr 2021 | $63.82 |

Total dividends received this month across all my portfolios - before tax

The Site – http://www.jesbaek.com

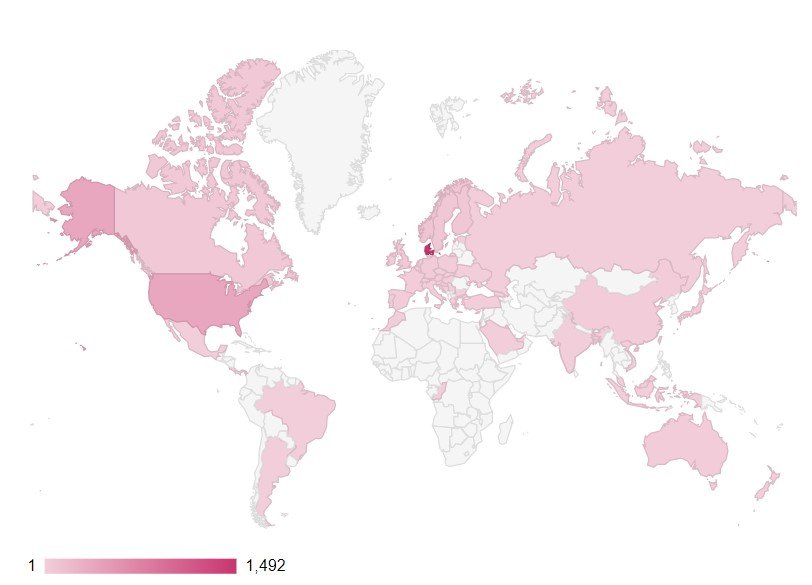

I continue to see a small increase in readers on my site every month. April marked a milestone of nearly 2.500 pageviews - an increase of 12% from last month. It is now the fourth month of growth for the site and I am really happy to see even more people visiting from new areas and sources. Facebook and Shareville continue to be my biggest referrers of new readers but also Twitter and Reddit are starting to pick up steam. The site now appears on all major search engines (Google, Bing, Baidu, Yahoo & duckduckgo), and to ever shared my post on femaleinvest.com - Thank you!

Around 1500 visitors from my home country of Denmark, nearly 400 from the US, and a few hundred from other Nordic countries. Also shout out to Canada, the United Kingdom, and Germany.

A good friend of mine helped me set up an easy way for people to subscribe to my mailing list - To receive all my new posts directly in their inbox. That has also helped immensely and is probably something I should have looked at a little earlier.

Personal

On a personal note, I have finally wrapped up my contribution to the Deloitte IT infrastructure workshop for my University and I look forward to receiving my payment from this sometime soon. I have also entered a period of heavy exam focus as I work on four different exam papers to wrap up my second semester. I cannot wait for this semester to be over as it is been quite the challenge to juggle four different classes at once all online. I am looking forward to passing my exams and enjoying a good long summer holiday before hopefully returning to campus and seeing my classmates and professors in real life again. I still have a few posts planned for the month of May, though I will be prioritizing working on my exams. I hope you all have had a great April. Stay safe and feel free to leave me a comment with feedback or any question you might have for me. Cheers!

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.