Monthly Update #001 - January 2021

Welcome to my first update on my investments, the site, and me. As you might have guessed this will be a monthly occurrence. In future updates, I will try these types of posts shorter and very concise but in this first one, I will be going over some of my more fundamental views on the companies I own.

My Investments

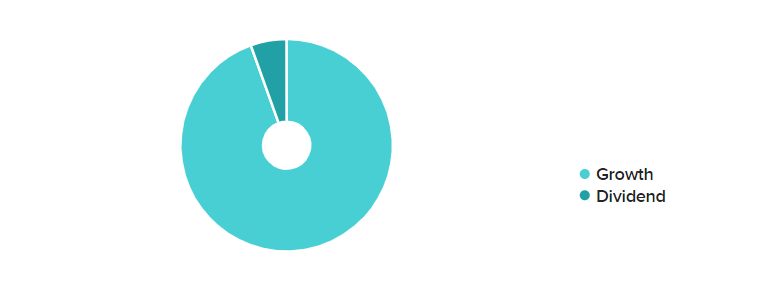

My investments consist of two portfolios: The first one is for growth stocks - I have spent the last 7 years building up this portfolio. It is primarily consisting of technology-focused companies and below I will clarify which. I have made no new investments within this portfolio in January 2021.

My biggest position by far is Tesla (TSLA) sitting at just below 60% of the entire portfolio. This is due to the stock’s incredible performance over the last year. I am currently sitting at a 1383% return. Only a little over a year ago this was only my third largest position. I bought my first Tesla shares in 2016 and two times since 2019. I fully support this company's vision and I believe it to be at the very forefront of innovation: The single most important aspect I look for when investing in a growth stock. I am not planning on selling any of my shares for at least the next 5 years - maybe not even this decade.

Moving on just about one-fourth of my portfolio consists of Microsoft (MSFT) stock. This was among my first investments when I started back in 2014. I bought it based on Satya Nadella's vision for the company - focused on the cloud and mobility and I could not have entered at a better time. My position is up 532% and though I still thoroughly believe in the company, it is one that I am decreasing my position over time. Last year I sold about 40 shares and I might do this as well this year - Purely getting the best tax optimization on my returns. All profits will be reinvested.

Novo Nordisk (NOVO B) is my third largest position and a stock many of my fellow Danes own along with me. I have held onto this stock since getting started and have seen a good return of 116%. It is the only non-tech growth stock I own and I might eventually sell out of it this year to invest in genomics/CRISPR - which I find to be a more attractive case in this decade going forward.

Over the past month, I have seen 17.5% growth in this portfolio. in comparison with the Danish C20 Index which dropped 2.2% in the same time frame.

Amazon (AMZN) trails closely at just below 4% of my overall portfolio. Another incredible cloud company (and so much more!) that I have followed for years and am glad I eventually bought into back in 2018. The price per share is incredibly tall in my opinion which is a slight annoyance for me as I do not have access to a brokerage offering fractional shares and this has been an obstruction in the past for me to buy more. Interestingly with this one, their founder and CEO Jeff Bezos, has just announced that he is stepping down from leading the company after 27 years. I will keep a close eye on this transition but I am glad to see Andy Jassy, the current CEO of Amazon Web Services taking over as his domain is the main reason for my interest in this company.

Taiwan Semiconductor Manufacturing Company (TSM) is my next new bet for the next couple of years and the place where most of my realized returns from Microsoft will go. I have an entire post dedicated to exactly why this is. The article also covers why I own Nvidia (NVDA). I do plan on buying more shares of TSMC in 2021.

Virgin Galactic (SPCE) is a fairly new addition to my growth portfolio and one that I am very excited about. I have not quite yet decided yet if this is one I will be holding for the long term or not, but it has been such a thrill to see it skyrocket over the last month. I am up 151% as of now - I got in at $22 per share late last year and I am looking forward to hopefully seeing Richard Branson as a passenger this year.

Last but not least we find Unity (U). An incredible company with an amazing product that I have used professionally myself for several years. Unity marks the first IPO I ever took part in and it has been a fun experience, to say the least. They have jumped 109% since I got in on the first day - something that I am torn about. My original plan for this company was to buy many more shares than I did, but given that it more than doubled only a few months after getting in I will have to set that goal aside for a little while. Unity is another position I will gladly be holding for at least a decade out and if the share price ever nears its entry price again I will certainly be on board picking up some more.

The companies that make up my dividend portfolio

My second portfolio is my newly founded dividend-focused portfolio - Consisting of high yield and stable companies spread across many sectors. In a post earlier this month I described my exact strategy and went in-depth with all my positions.

I have made one significant purchase within this portfolio this month, namely 3M (MMM). I mentioned it as a company I could almost guarantee picking up in 2021 and well, this has now happened. As with all my dividend stocks I plan on holding this position for the rest of my life. 3M yields a dividend of 3.36% and I can safely expect this number to increase over the years.

In January I received dividends from Federal Realty Investment Trust (FRT), Realty Income (O), and AT&T (T) resulting in a total of 378 DKK before taxes or 500 DKK if you include TSMC which sits in my growth portfolio yet also pays a dividend. 500 DKK is approximately 80 USD - A good start to my dividend journey.

My dividend portfolio also growth in January 2021, though much more modest.

The Site - www.jesbaek.com

This website went live on the 1st of January 2021. It is a project I have been interested in starting for a while and I am happy that I finally took the chance to do it. I love sharing my thoughts on investing and technology with others I am very grateful for the response I have gotten so far and so quickly.

I have gotten 1300 views on my website from 927 unique visitors in my first month being live. My best performing article had 627 views and is the one covering passive income and dividend investing. This is in contrast to my first post receiving a total of 48 views as of yet. Many of you find me through Shareville and Facebook, but I can also see some traffic coming from search engines and platforms I have never even heard of. That is great.

Here is a cool breakdown of where my readers are from. Thank you all so much!

I also managed to update my homepage a bit by the end of the month to make it a little easier to understand who I am and what all this is about. As soon as I did that I saw a significant increase in the number of visitors reading more than just one article. Awesome! I hope to improve these things much more in the future. I have also added an option there if you would like to support me in my journey towards financial independence. Also thanks for all the comments, likes, and feedback I have received!

Me

I just wanna finish off by giving a tiny life update on me. As of February 1st, I started my second semester at The IT University of Copenhagen. I faced three exams in January which all thankfully went really well.

This semester I will be juggling four different courses: Digital Culture & Media, User Interface Design, Physical Computing, and User surveys & quantitative methods. Unfortunately due to the pandemic all four of these will take place online - something that I wish will soon change, especially in regards to physical computing in which I am looking forward to playing around with some robots and other cool stuff.

The pandemic also put a temporary hold on my income in January as the lockdown shut down many operations at work and I as a part-time employee, unfortunately, was deprioritized. I am back to working again in February and I have also signed up for a paid IT strategy workshop by Deloitte to improve the IT structures of the University I attend.

That was all for now, thanks so much for reading. Feel free to reach out in the comments if you have any questions for me or if you have feedback or suggestion in mind.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.