January 2022 - A tough start to the new year

Hi there! This is my first entry in my newly launched investment journal.

Consider this an improvement on my monthly updates where I with this format change hope to deliver more value for myself as well as my readers.

Keeping an investment journal is something I have been recommended time and again - and as some of the most successful investors I know already do keep one I thought I would give it a shot as well. However, they seem surprisingly hard to come by online and so I have decided to share mine. Feel free to let me know what you would be most interested in me sharing.

Changes to my portfolio this month

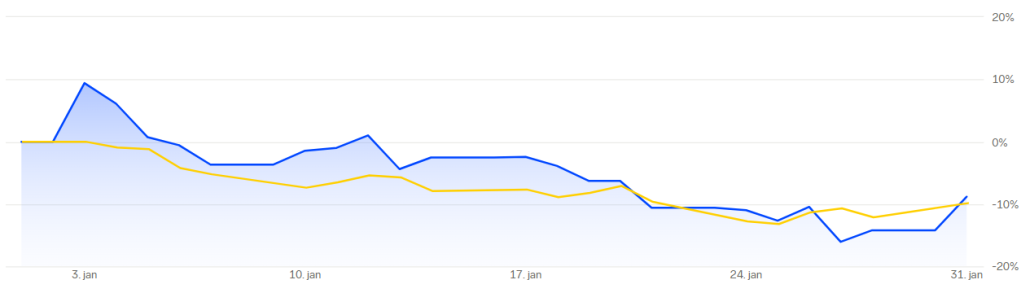

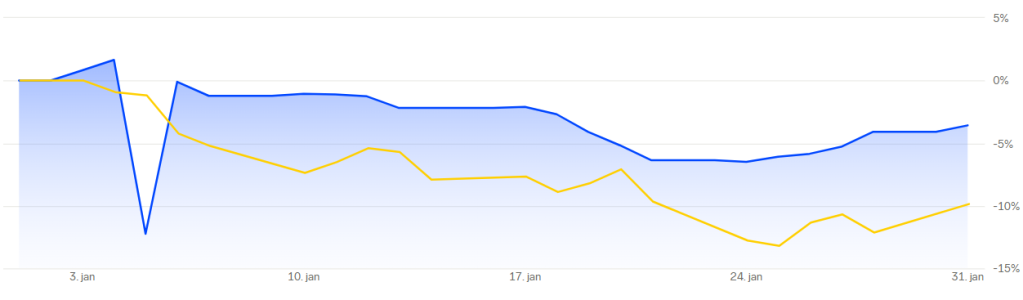

With the market correction of January 2022 - which in fact became nearly the worst January of all time it has been a tough start to the new year for any investor. Some markets even entered bear territory right before we were saved by the green on January 31st. As a long-term investor, this became an opportunity for me, although not without its caveats.

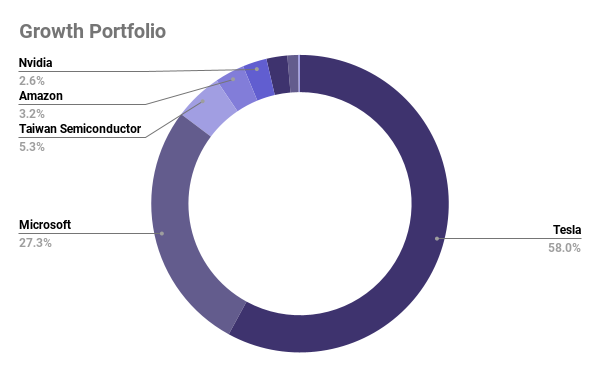

Growth Portfolio

Overview

Unlabeled on the chart from left to right: Unity (2.3%), Xiaomi (1.15%) and Coinbase (0.2%).

Moves

On the 10th I sold approximately 1.5% of my Tesla (TSLA) shares at a price of $1005.

The reason for doing so was to purchase more shares of Unity (U) which I did the very same day at a price of $115.71 per share.

This process repeated on the 14th as I sold another 1.5% of my Tesla shares at $1035.68 in exchange for another chunk of Unity stock at $116.

Performance

Overall, the value of my growth portfolio decreased by 8.83% much in line with the rest of the market. The index I benchmark against is OMXC25.

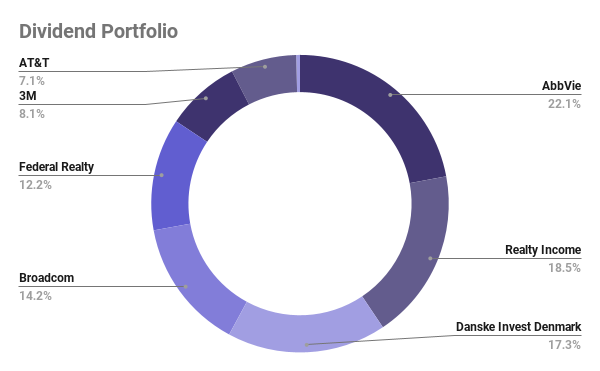

Dividend Portfolio

Overview

Unlabeled on the Chart: Orion Office REIT (0,4%).

Moves

A small automatic buy order of the Danish Invest Denmark Index ETF went through on the 10th - nothing out of the ordinary here.

Performance

The value of my Dividend Portfolio went down only 3.58% showcasing some resilience.

Note: The large cliff/recovery in January is not an actual event but the result of my brokerage platform temporarily setting the value of Federal Realty (FRT) to zero during its restructuring.

Dividend overview

| Name (Ticker) | Received | Amount (USD) |

| Broadcom (AVGO) | Jan 3rd | $20.33 |

| Realty Income (O) | Jan 17th | $13.35 |

| Federal Realty (FRT) | Jan 20th | $21.19 |

| Total | Jan 2022 | $54.87 |

| Comparison YoY | $42.55 (Jan 2021) | +$12.32 |

Dividends received before taxes. Comparison to the same month a year prior.

Commentary & Review

In this section, I aim to explain my actions and articulate my reasons, as well as reflect on the market in general, my performance, or anything else noteworthy. Some months I may be briefer than others - It depends entirely on what has been going on and what I find relevant to share.

Sale of Tesla and addition to Unity

While the correction has been just as tough on me as for the overall market, it did present me with an opportunity I could not forgo: Increasing my position in Unity, the leader in 3DRT and one of my highest conviction companies. But with no cash on hand, it also meant that I had to sell out of one of my existing positions. While not particularly enjoyable for me I decided on cutting down a little bit on my Tesla stock - despite continuing to be extremely bullish on their future.

I settled on this option as I have already cut down on my other large position in Microsoft (MSFT) over the years and it just continues to do well. As Tesla has gained and returned more than 16x for me it has ended up making up more than 60% of my Growth portfolio at one point. And while I do not mind a large concentration at all, I do take on increased risks having more than half of my net worth in one stock. The other big differentiator is that Microsoft pays a dividend, while Tesla does not and I have come to appreciate that much more in recent years. This move also falls in line with a strategy I have always liked: Covering your original entry when taking profits long term. Selling of 3% has nearly helped me reach that goal already.

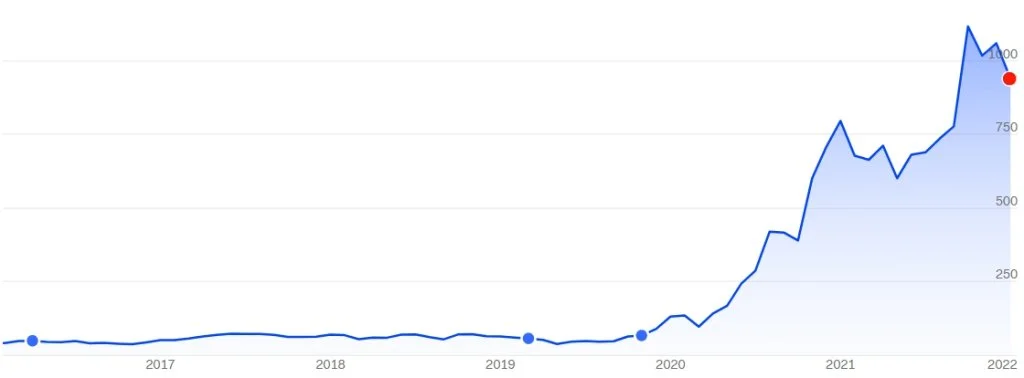

Since my first purchase in 2016 (blue dots) and again in 2019, TSLA turned into my best performer ever. I sold around 3% this month (red dot), which nearly covered my buys.

I am glad I sold when I did as the market took a turn for the worse. As of writing, this Tesla is still trading below $1000 despite delivering an incredible earnings report as well as a very promising earnings call. Investors seemed disappointed by ongoing supply chain issues and delays in the product roadmap - despite that already having been communicated publicly. On the flip side, Elon Musk confirmed that their next generation and incredibly efficient 4680 battery cells are now in production and will be inside delivered vehicles in this very quarter. Their margins are far above the average and the company is now so confident in its production capabilities that it can shift more focus towards software revenue and services, their energy section, and autonomy.

In hindsight, I of course wish I had held onto the cash from my Tesla sale until the end of this month as Unity dropped below $100. I got it for a little under $116, but that just goes to show how difficult timing the market actually is. In the future, I might consider giving a little more headroom before jumping on an opportunity in a market like this. But at the very least I got a fair price for my Tesla shares (although in my honest opinion slightly too little). Unity is now trading at $106, which is just above my own average, considering my original entry on the day of their IPO at $69 per share. Should Unity continue trading below $100 I will allocate every spare cent towards increasing my position herein - hopefully also from funds generated from my income rather than stock sales alone. Their acquisition of Weta has only made me more bullish and my thesis on the strategy of the acquisition was supported recently by another one - their purchase of Ziva Dynamics - who already have some experience turning powerful VFX software into next-generation real-time tools.

Over at Twitter, following my additions to my position in Unity I made a thread, quickly summarizing why exactly I want them in my portfolio. This allowed for some great conversations and did relatively well for me considering my still small following there:

Shoutout to Aktieuniverset (Stock Universe), my favorite Danish podcast.

Dividends

Additionally, I would just like to point out that I am happy to see an increase in my dividends for January year over year and that I hope you like this new addition to the table. Generally, my dividend portfolio continues to impress me with its resilience, giving up less than 4% during this month and providing me with steady dividends no matter how dire the situation may be.

I am now looking forward to a sizable payout from my Danish ETF next month.

Research & Goals

This month has taught me a lot about the markets and my own temper in a downturn out of the ordinary. March of 2020 was not as tough on me as many others and so this is actually the first time I have experienced real continuous obliteration of my assets. But my gut and high conviction in what I own have helped me overcome irrational feelings and I remain committed to my long-term strategy of investing in what I know. I have spent some time reminding myself of why by listening to both Peter Lynch and Warren Buffet as I have seen others panic and destroy their chance of recovery. As for my watch list, which until now has not been shared publicly, a few new additions have been made:

Watch List

Growth Portfolio

| Name (Ticker) | Conviction (Rank) |

| Alphabet (GOOGL) | 1 |

| Shopify (SHOP) | 2 |

| Sea (SE) | 3 |

| Meta (META) | 4 |

| Embracer (EMBRAC B) | 5 |

| Palantir (PLTR) | Contender |

Note that many of these may already trade within desirable price ranges for me but may overlap with current holdings with higher conviction or are simply on hold due to lack of funds.

Dividend Portfolio

| Name (Ticker) | Conviction (Rank) |

| Costco (COST) | 1 |

| E.ON (EOAN) | 2 |

| Digital Realty (DLR) | 3 |

| Bank of Nova Scotia (BNS) | 4 |

| Lockheed Martin (LMT) | 5 |

| Starbucks (SBUX) | Contender |

Note that many of these may already trade within desirable price ranges for me but may overlap with current holdings with higher conviction or are simply on hold due to lack of funds.

I will mention that some of these stocks may already be part of my private Stocks Savings Account briefly described in December 2021 - but have not yet graduated to be long-term holdings. New to the list this month are Bank of Nova Scotia and Digital Realty who coincidentally both have been on my watch list before and removed again due to various factors. As is Starbucks which I find it interesting at current levels, although the yield is still a little low for the strategy I have chosen. I plan on publicizing this list every month from now on, but understand that it may not see changes very often. I would also like to mention that I do keep an eye on more stocks than these, but have decided to limit the list to only my highest contenders - and so you may see things swapped around every once in a while.

Goals

Short term I wish to continue to increase my position in Unity and possibly Coinbase also.

For the year 2022 while generally focusing more on growth stocks than in the year prior I still aim to start at least one new position in my dividend portfolio.

I have no current plans to open any new positions in my Growth Portfolio, but rather to add to my newest additions. This includes Xiaomi although this is less likely to happen.

I still plan on selling a little more Tesla stock in order to maximize profit taking compared to my tax bill. This will be reinvested.

In my 2021 year in review, I stated that I aim for a 35% return in 2022. This is still the goal I am reaching for although much harder now given January's ruthlessness.

Over the long term, my goal is to slowly shift towards more stable positions and dividends on my journey of financial freedom.

The end

Phew, that was a long one. Finally, I would like to issue a huge thank you to those who clicked on and read my recent piece on the Nvidia/Arm situation. It quickly became my most successful article to date. Also thanks to those who have supported me this month - donations are highly appreciated as I still pay far more for keeping this site online than I make from running advertisements. (It comes out to around negative $100 per year right now). I am fortunate to have had success in the stock markets, but as a University student, I have very little to reinvest from my monthly income.

That is all for now. Thank you for reading! I would truly appreciate any feedback on this new format change - Did I miss anything important? Do you like the new additions? Is there something I did before that you would like back? Let me know. Best of luck to you for the rest of 2022.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.