November 2022 - The Buffett Effect

This month has been full of great news: The challenging macro environment has finally started to ease with rising inflation finally slowing down and indications of a softer interest rate hike in December. I also had Warren Buffett pick up shares in one of my largest positions. But at the same time, there has been a lot of bad: I was forced to exit one of the most reliant positions in my Dividend Portfolio and in my Growth Portfolio my biggest holding continues to plummet.

Changes to my portfolio this month

There has been no trading activity in my growth portfolio this month.

Growth Portfolio

Overview

Unlabeled on the chart: Alphabet (1.5%), Adobe (0.8%) and Coinbase (0.1%).

Moves

No changes this month

Performance

My Growth Portfolio lost another 6.90% of value this month, underperforming the market significantly, largely due to my no. 1 position.

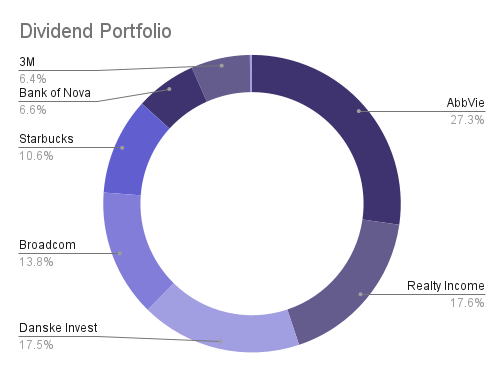

Dividend Portfolio

Overview

Unlabeled on the chart: Orion Office REIT (0.2%).

Moves

A small automatic buy order of the Danish Invest Denmark Index ETF went through on the 8th - Which I aim to continue doing every month this year.

On November 23rd I sold my entire position in Federal Realty Investment Trust (FRT) at an average price of $109.53 marking a return of 54.40%.

On November 30th I started a position in Bank of Nova Scotia (BNS) at an average price of $70.51 (CAD).

Performance

My Dividend Portfolio rose 4.13% in November though still underperforming the market.

Dividend overview

| Name (Ticker) | Received | Amount (USD) |

| AbbVie (ABBV) | Nov 16th | $46.91 |

| Realty Income (O) | Nov 16th | $13.74 |

| Starbucks (SBUX) | Nov 28th | $10.66 |

| Comparison YoY | $116.01 (Nov 2021) | $71.31 (-$44.70) |

Dividends received before taxes. Comparison to the same month a year prior.

Commentary & Review

Let me start by sharing the highlight of my month in investing: Warren Buffett’s fund Berkshire Hathaway (BRK) disclosed having opened a large stake in Taiwan Semiconductor Manufacturing Company (TSM) - my fourth largest position. Having increased my own stake in this company just last month it was quite something to experience The Buffett Effect on my own portfolio for the first time. The stock jumped over 15% in a single day of trading as it now bears a seal of approval from the most successful investor of all time. Just like me, this is a serious bet for Buffett - TSMC has made it right into the top 10 of Berkshire’s public portfolio. Looking at fundamentals it is easy to see why: TSMC remains in a class of its own. But what this also means is that the most well-informed investor is aligned with my thesis on how the China threat to Taiwan is overplayed.

Despite this huge jump, my Growth Portfolio overall still decreased in value. This can almost entirely be attributed to my largest position Tesla (TSLA), which valuation has dropped drastically - continuing the trend of last month. Interestingly, the company continues to execute impeccably, but the noise surrounding Musk and Twitter continues to add downward pressure on the stock. Production numbers out of China and other places are reported far beyond expectations. Tesla has widened its Full Self-Driving Beta to anyone in North America and shipped its first units of the long-awaited Semi truck. Q4 could be a major inflection point and I believe many smart, more traditionally conservative investors might be ready to jump on the opportunity now.

Mixing up the bad with some good again, the macro environment improved dramatically in November. The US inflation report revealed numbers far better than expected and we saw a massive lift in the markets fueled by optimism. This optimism may have been justified as the month ended with Fed chairman Powell alluding to a softer interest hike in December. The macro has also had a positive impact on my unfavored growth bet Unity (U) which finally saw some pressure lifted off it. Currently, the stock trades at around $40, up from about $22 the day before reporting earnings. I am now ‘merely’ down 25% and can rest easy as things are finally easing up. Profitability in 2023 is on track and the merger of ironSource (IS) is now finalized. I shared my in-depth thoughts on the quarterly earnings in a Twitter thread (open to read the whole thing).

Finally, we get to the last bit of bad news: I received a letter from my brokerage this month, forcing me to exit one of the most reliant positions of my Dividend Portfolio: Federal Realty. This REIT was the very first position of my dividend-focused portfolio and has provided me with a steady stream of income from day one. Yielding nearly 5% and having grown 50% on top of that I had very little reason to ever let go of this stock. Unfortunately, earlier this year, the company restructured into what is called a Publicly Traded Partnership, which apparently from next year is underlaid massive US domestic taxation. I was told that I would be able to sell my shares before the end of the year with no brokerage fee as the platform could no longer host these types of investments. I did so on the 23rd, after a few days of hesitation, and have now picked up a starter position in the long-time no. 1 position on my Dividend Portfolio Watch List: Bank of Nova Scotia. This grants me well-needed exposure to the financial sector and a stake in an impressively stable institution. BNS actually yields slightly higher than FRT ever did, which I appreciate, although I have only put around half of my FRT funds into this stock as I await and look for another potential opportunity in the market.

Dividends

As clearly seen on the dividend table, November of this year has yielded drastically lower than last year. This is again due to my exit of AT&T (T) which was a major contributor to my passive income goal. For November, Starbucks (SBUX) does not come near closing this gap with its 2% yield - but what I get in return is fortunately much better: A healthy, growing business with a great brand presence. Starbucks is now up nearly 30% since I started my position earlier this year and has just hit the $100 per share mark again.

Research & Goals

Outside of following Musk’s endeavors with Twitter this month - including declaring war on Apple (AAPL), only to make peace again shortly after (phew), I have spent some time researching disclosures of new positions among major investment funds, like what Berkshire did with TSMC. Among them, Otis (OTIS) managed to grab my interest, and so it has found a place on my Dividend Portfolio Watch List. Otis is as run-of-the-mill as it gets: It is an elevator company - however, it is also one that I am oddly familiar with and which I would have gladly invested in sooner had I known they had become publicly traded. Otis was spun off from Raytheon (RTX) in 2020, under the pandemic, which may be why I missed it. Otis is a very old organization and one that makes great products. For why I know anything about the elevator business at all is something I do not have time to explain quite yet.

Watch List

Growth Portfolio

| Name (Ticker) | Conviction (Rank) |

| Embracer (EMBRAC B) | 1 --- |

| Sea (SE) | 2 --- |

| Meta (META) | 3 --- |

| Shopify (SHOP) | 4 --- |

| Palantir (PLTR) | 5 --- |

| MercadoLibre (MELI) | Contender |

Dividend Portfolio

| Name (Ticker) | Conviction (Rank) |

| Costco (COST) | 1 ↑ |

| Otis (OTIS) | 2 New |

| Elkem (ELK.OL) | 3 --- |

| Coca-Cola (KO) | 4 ↑ |

| PepsiCo (PEP) | 5 New |

| Lockheed Martin (LMT) | Contender |

As described above, Otis has joined the Dividend Portfolio Watch List - and quite high on the list as well. Costco (COST) has taken back the prime spot as Bank of Nova Scotia has made it into my actual portfolio. Coca-Cola (KO) which made the list last month has moved up in favor of JP Morgan (JPM), which is now off the list as I now have exposure to the financial sector through Bank of Nova Scotia. JP Morgan also happened to regain much of its value in the few past months and I no longer find it quite as attractive, considering this and the decision made to stop its share buyback program not too long ago. Taking up the 5th spot now is PepsiCo (PEP) which in reality is exactly as interesting to me as Coca-Cola - I will likely have to make my choice between the two at one point or another. I am a Coca-Cola drinker and personally strongly prefer their products, however, I really like how PepsiCo has diversified its business with snacks/food products. PepsiCo also became the first customer of the Tesla Semi, which serves a small indicator to me that its management is forward-thinking.

Goals

I have no plans to open new positions in my Growth Portfolio.

I do not plan on selling out of any more positions this year.

In my 2021 year in review, I stated that I aim for a 35% return in 2022. I continue to strive toward this goal although I have accepted its unlikeliness. Currently, I am down 32.07%.

Over the long term, my goal is to slowly shift towards more stable positions and dividends on my journey toward financial freedom.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.