Why Tattooed Chef is the most attractive plant based stock right now

Exiting my long term position in Virgin Galactic (SPCE) which you can read more about in last month's update, I unexpectedly had the opportunity to buy into a new position - It did not take me very long, as I had been eyeing a particular stock for a while. That stock is Tattooed Chef (TTCF) and here is why.

Tattooed Chef is a plant-based frozen foods company and went public in October 2020 via SPAC. This sentence alone probably makes you think a lot of things - and I would not blame you at all for thinking this is simply another overhyped stock riding a current megatrend. Now, I have no problem buying into megatrends - my most successful investments have actually both been that: Tesla (TSLA) with electric vehicles and Microsoft (MSFT) with Cloud - and maybe common for both: Data & AI. However this is not just that. I know that the world is talking about a vegan craze and that everyone is looking to eat more sustainably produced products - even frozen foods have been taking off since the start of the pandemic. But it really is not just that. There is much more to this company...

This company has a 'secret'...

Before merging with blank check company 'Forum Merger II' for their SPAC, Tattooed Chef were known as 'Ittella' and was founded in 2009. 'Ittella' began as an importer of Italian vegetables and other produce into the United States, and later in 2015 turned into a 'Ittella International' as a private label producer and manufacturer. Private label are products produced or manufactured by a company for sale under another company's brand. This is a practice often seen in the food retail space as many large supermarket chains carry their own store brands. The Tattooed Chef brand is the company's own brand and has been their core focus driving revenues and future profits. What all of this means however is that Tattooed Chef is essentially operating a successful 'shadow business' which is sustaining their new investment heavy business. It also means that they have already well established business connections and their supply chain under control. These are huge benefits in the space and a major reason why this stock was more appealing to me than Beyond Meat (BYND) and The VeryGood Food Company (VERY).

Tattooed Chef logo

The company's own in house brand is what the company now takes name after.

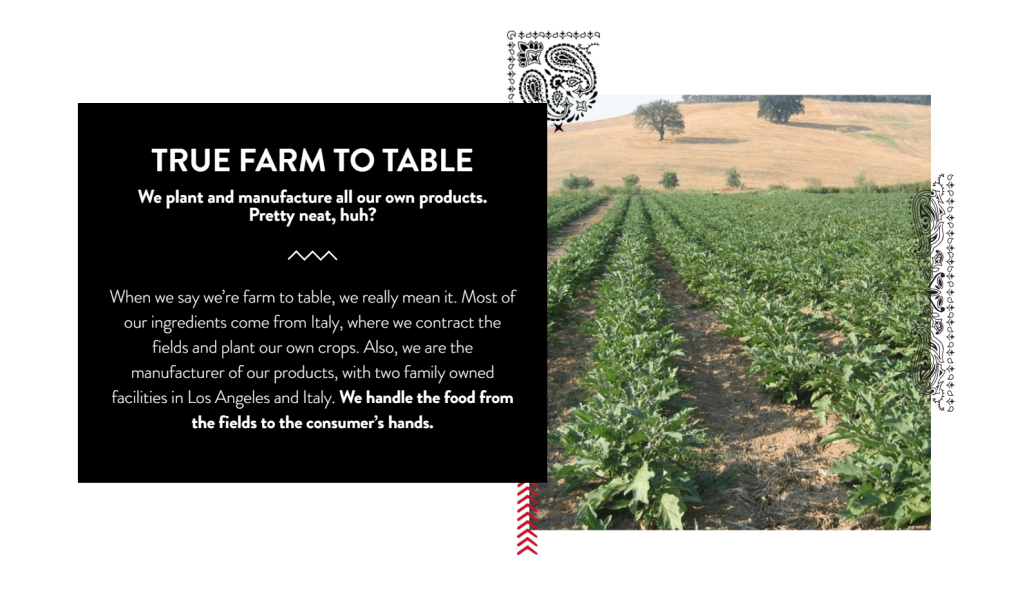

All this also points to TTCF being a vertically integrated operation:

They own the farms where they harvest their ingredients

Experience in importing gives them an edge in moving the products

They manufacture the final product and create/improve the recipes

They provide their own brand and advertising.

This is another unique factor about this company and one always praised highly amongst investors. I am not hugely versed in the food industry space in general, but it would surprise me if this is common practice. For most food items sold in grocery stores today profits are not huge - It is the volume that counts. That will likely always be the case, but owning the entire chain from production to shelf is probable to some day boost margins. Vertical integration is always seen as a big plus in startups of the tech space where I usually dabble and I am sure it will benefit this company over the long term as well.

Tattooed Chef calls it "Farm to Table". Also, a good way to build trust with your consumers about the contents of their recipes.

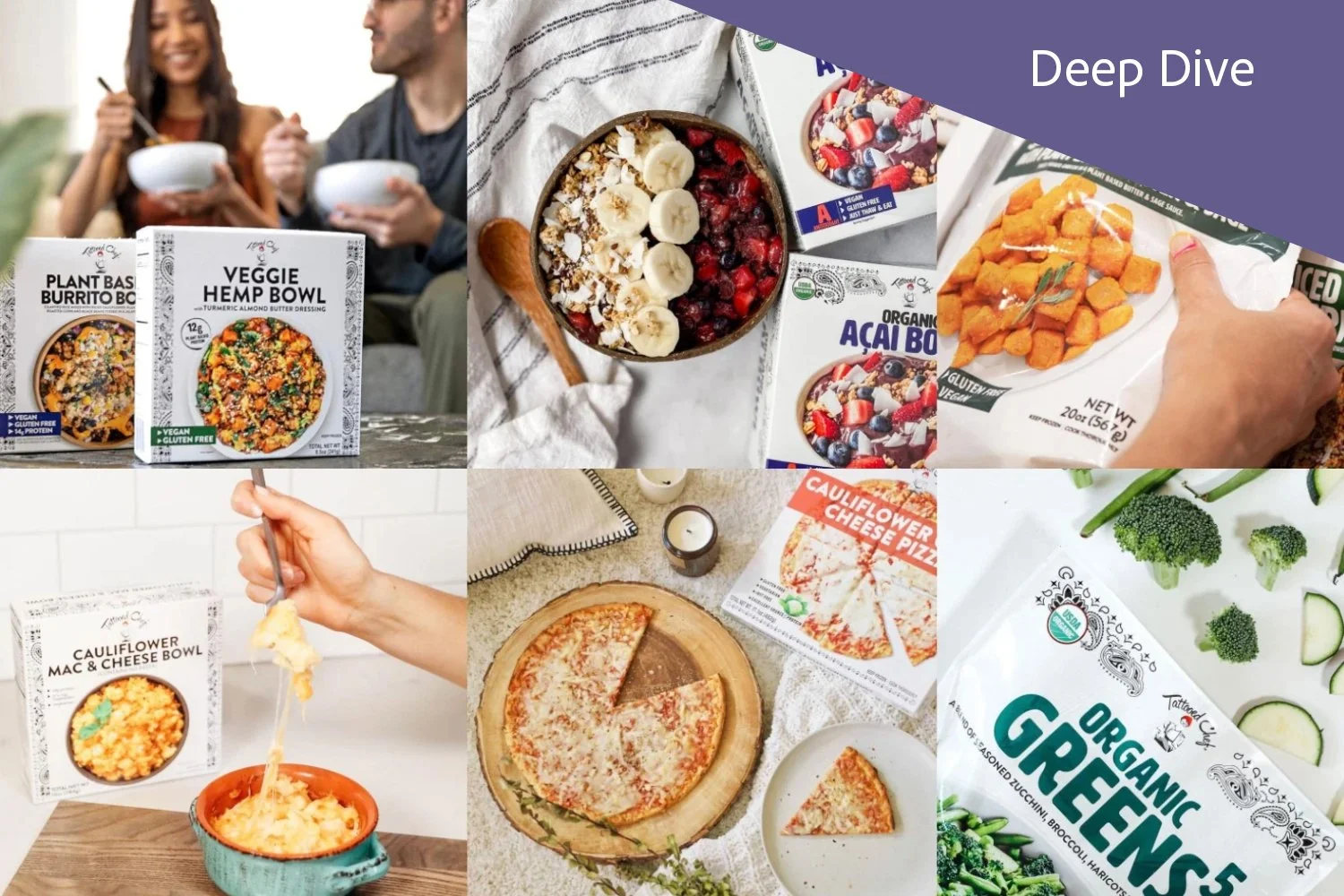

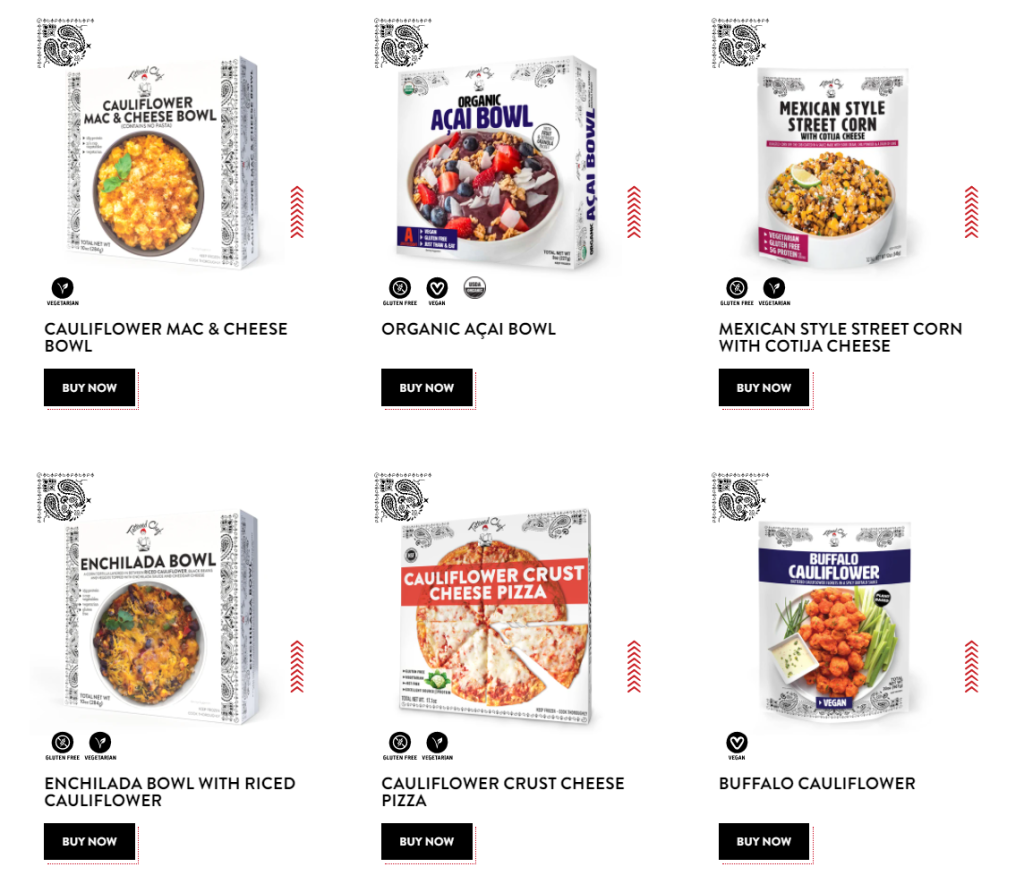

Partners and products

You can find Tattooed Chef products in the largest retailers across the states. They are available in Walmart, Costco, Sam's Club, and Bristol Farms and their products are reportedly hugely successful in Target:

Target said it was the most successful frozen food launch In the history of Target...

Salvatore Galletti, CEO, Tattooed Chef Q1 2021 Earnings Call

Just recently their products launched nationwide in Whole Foods as well. Whole Foods is, not to forget, owned by Amazon (AMZN) since 2017. Amazon is another one of my holdings and a frontrunner in transforming the physical grocery retail space, so besides loving to see some of my favorites come together I also believe Amazon to be the most powerful ally to have in this space in an era of transformation. I have a lot more thoughts to share on how we in the future will get our groceries and other everyday items, but for now I will leave you with a teaser of what got me excited about it in the first place, back in 2016.

As of now Tattooed Chef only offers frozen food items for purchase. They all look delicious and are ready to eat within 6-7 minutes of preparation. I have not yet had the chance to try them, but that may not be too far off now as rumors point to a not-too-distant launch in Europe, or at least in the UK. But TTCF is also looking to expand into the category of 'ambient foods'. These are products that can be stored at room temperature in a sealed container and remain safe for eating. This includes canned items and products in flexible pouches which usually enjoys a longer shelf life and that could also benefit the company's bottom line someday. It would also diversify their product portfolio and serve the needs of other types of customers - Overall just another great thing if and when it becomes a reality.

A small selection of the Tattooed Chef branded products available to buy in US stores today.

Our plant-based future

In the introduction, I briefly mentioned megatrends and a so-called vegan craze and that certainly is another good reason and the most obvious to be excited for the future of this company. Plant-based foods and vegan options are more popular than ever as the general consumer grows aware of their own carbon footprint. My local supermarket chain even presents the impact my buying habits have on the planet and is now actively encouraging their customers to think twice about their purchases in this regard. Recently in my own home, we have also made adjustments, eating less meat and have discovered great plant-based alternatives to some of our favorite dairy products and snacks.

TTCF's total addressable market sits at around $50 billion and is growing at a compounded annual pace of 17%. There is a lot to be excited about in this space, the trend is very clear and that alone is a good enough reason to be in this stock. But it also means that the company will face steep competition over the years and many already established house-hold brands in these categories will try to compete in this field as well. Tattooed Chef has not yet been advertising their products until 2021 and while numbers show lots of repeat customers and great market penetration, they will be at a disadvantage compared to larger brands that people know and trust already. Beyond Meat, which I briefly mentioned before has led a very successful marketing campaign and managed to build great brand value in a very short amount of time - It still remains to be seen whether or not Tattooed Chef can follow up and do the same.

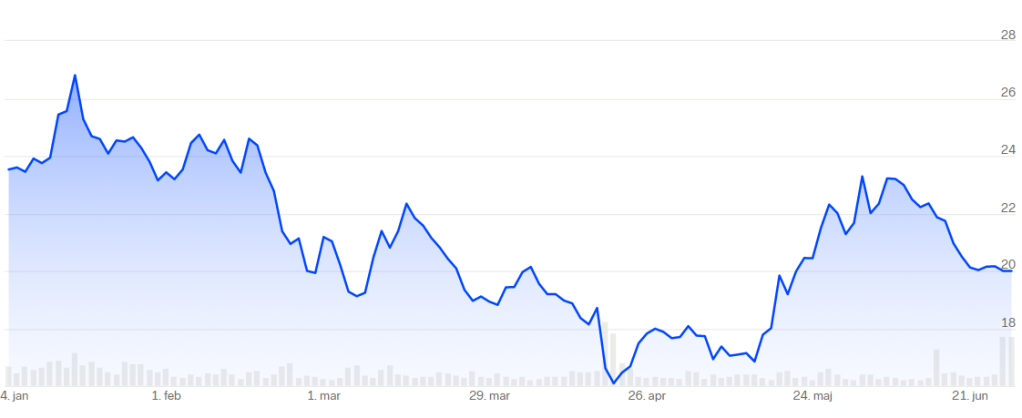

Recent ups and downs

There are many things I like about this company, but as with most newly established public companies there are increased risks to be aware of and I would be remiss to not mention the recent controversy surrounding the stock. In fact, my entry point into this stock at a price of $17 per share came following a drastic selloff in April. Earlier in the year, In mid-January the stock price climbed to $26 - an all-time high. Currently, we are sitting at $20, so what gives? Like with most other growth stocks this year the drop can be attributed in part to the market reacting to rising interest rates and inflation. We have seen a general shift towards value-oriented stocks and an exit out of high-risk, capital-expensive growth companies and TTCF is far from alone in this.

The stock is down 12% YTD while I am up 17% on my own position from April 19, 2021.

However a much bigger reason for why the stock further dropped in April of this year is connected to the sudden resignation of the company CFO. He left effective immediately after the disclosure by the company in an event that worried many investors. A story came out of the company CEO, Salvatore Galletti, disposing of 800.000 shares at a much lower price than the company is valued at of $10 per share. He then shortly after sold of another 500.000 shares for essentially nothing. This created a lot of FUD and the stock dropped almost 10% overnight - an understandable reaction to be sure. His actions have later been addressed by the company officially in a SEC filing and attributed to a privately negotiated deal, Mr. Galletti had with his lenders to cover personal debt. I appreciate the effort to justify the move, but it still makes me a little uneasy and makes me question the leadership of the company. I have no clue as if this debt is a sign of bad economical practices by the CEO or if it is an admirable sacrifice he had to make in order to make the company the success it is today.

On the flip side, their new CFO, Stephanie Dieckmann is an experienced CFO in the food space and already employed in the company prior to her new role and in my opinion seems like an overall better fit anyways. And in May, shortly after all this negative press, the company announced their plans to acquire New Mexico Food Distributors Inc and Karsten Tortilla Factory. For $35 million in cash Tattooed Chef will overtake the production and distribution channels of the Albuquerque-based ready-to-eat Mexican food offerings. This allows the company to grow into the Hispanic/Southwest food sector and immediately address a supposed $1 billion market of frozen Mexican foods. Tattooed Chef believes this new acquisition will be able to contribute up to $200 million revenue annually in the next two to three years - making this seem like the deal of a lifetime. Certainly it was a great start to my journey with the stock and it has prompted me to be even more bullish on the future of this company.

Disclaimer: I am not a financial advisor, the opinions expressed in this article are entirely my own – always invest at your own risk.